(Reuters) -Eli Lilly hit $1 trillion in market value on Friday, making it the first drugmaker to enter the exclusive club dominated by tech giants and underscoring its rise as a weight-loss powerhouse.

Here are some reactions to Lilly joining the trillion dollar club:

EVAN SEIGERMAN, ANALYST AT BMO CAPITAL MARKETS

"The current valuation points to investor confidence in the longer-term durability of the company's metabolic health franchise. It also suggests that investors prefer Lilly over Novo in the obesity arms race. Taking a step back, we're also seeing money rotate into the sector as investors may be worried about an AI bubble."

HANK SMITH, DIRECTOR & HEAD OF INVESTMENT STRATEGY AT LILLY SHAREHOLDER HAVERFORD TRUST

"Investors have historically liked secure earnings growth and (Eli Lilly) is the only large cap pharma that has that kind of earnings profile."

(Reporting by Siddhi Mahatole and Shashwat Chauhan in Bengaluru; Editing by Leroy Leo)

LATEST POSTS

- 1

The Most Rousing Ladies Business visionaries of Today07.07.2023

The Most Rousing Ladies Business visionaries of Today07.07.2023 - 2

Step by step instructions to Analyze Senior Insurance Contracts Really.19.10.2023

Step by step instructions to Analyze Senior Insurance Contracts Really.19.10.2023 - 3

Europe's powerful Ariane 6 rocket launches Sentinel-1D Earth-observation satellite to orbit (video)04.11.2025

Europe's powerful Ariane 6 rocket launches Sentinel-1D Earth-observation satellite to orbit (video)04.11.2025 - 4

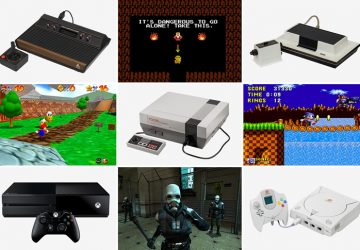

The Main 20 Gaming Control center Ever07.07.2023

The Main 20 Gaming Control center Ever07.07.2023 - 5

IDF carried out mission to locate former hostage Avera Mengistu a day before Oct. 710.12.2025

IDF carried out mission to locate former hostage Avera Mengistu a day before Oct. 710.12.2025

Illustrations Gained from a Crosscountry Excursion

Illustrations Gained from a Crosscountry Excursion We may have one thing in common with jellyfish, new research finds

We may have one thing in common with jellyfish, new research finds DEA seizes 1.7 million counterfeit fentanyl pills in Colorado storage unit

DEA seizes 1.7 million counterfeit fentanyl pills in Colorado storage unit AfD faction in western Germany ousts councilman for firebrand speech

AfD faction in western Germany ousts councilman for firebrand speech See as Your #1: These Low-Sugar Food sources You Ought to Attempt

See as Your #1: These Low-Sugar Food sources You Ought to Attempt Glamour Shots once ruled the mall. I went to one of the last ones standing.

Glamour Shots once ruled the mall. I went to one of the last ones standing. 2024 Watch Gathering: The Best Watches of the Year

2024 Watch Gathering: The Best Watches of the Year German foreign minister heads to China to talk rare-earth exports

German foreign minister heads to China to talk rare-earth exports Game theory explains why reasonable parents make vaccine choices that fuel outbreaks

Game theory explains why reasonable parents make vaccine choices that fuel outbreaks